Filing a tax return is an important task for everyone who earns money. After you file your tax return, many people feel anxious and want to know what is happening with it. Is it being processed? Has the tax office approved it? How long will it take to get a refund? Knowing how to track your tax return can make this process less stressful. In this guide, we will explain step by step how you can track your tax return in simple words.

Why It’s Important to Track Your Tax Return

Tracking your tax return helps you stay informed. When you know the status of your return, you can avoid surprises. For example, if the tax office needs more information, you can provide it quickly. Tracking also helps you estimate when you will get your refund. Many people feel worried after filing because they do not know what is happening. By tracking your tax return, you can reduce stress and be ready for any issues.

Knowing your tax return status also helps you plan your finances. If you are expecting a refund, you can plan for bills or savings. If there is a problem, you can take action early. In short, tracking your tax return is a smart and responsible step after filing.

Tax-Free Threshold

When filing your tax return, it is important to understand the tax-free threshold. In Australia, the tax-free threshold is the amount of income you can earn before paying any income tax. Currently, individuals can earn up to $18,200 in a financial year (July to June) without paying tax. If you earn less than this, you generally do not pay tax. If you earn more, you only pay tax on the income above this amount.

When you lodge your tax return, the tax office checks if you have claimed the tax-free threshold with your employer. This helps make sure you do not pay too much tax during the year. Knowing about the tax-free threshold can also help you understand your refund. If you paid more tax than required, you may get a refund after your return is processed.

How Long Does It Take to Process a Tax Return?

The time it takes for a tax return to be processed depends on how you submit it and the complexity of your tax information. If you file your tax return online, it usually takes less time. Many online returns are processed within a few weeks. Paper returns may take longer because the tax office has to enter the information manually.

In Australia, income tax returns lodged with the Australian Tax Office may take about two weeks to process. This is the average time for many simple returns, especially if they are submitted online.

Simple tax returns with basic income and deductions are usually processed faster. Returns with more details, such as business income, rental income, or investments, may take longer. If the tax office needs more information, the process may take extra time.

Even though waiting can be frustrating, understanding the average time frame can help you be patient. Most tax authorities provide updates or time estimates, so you know when to check your return.

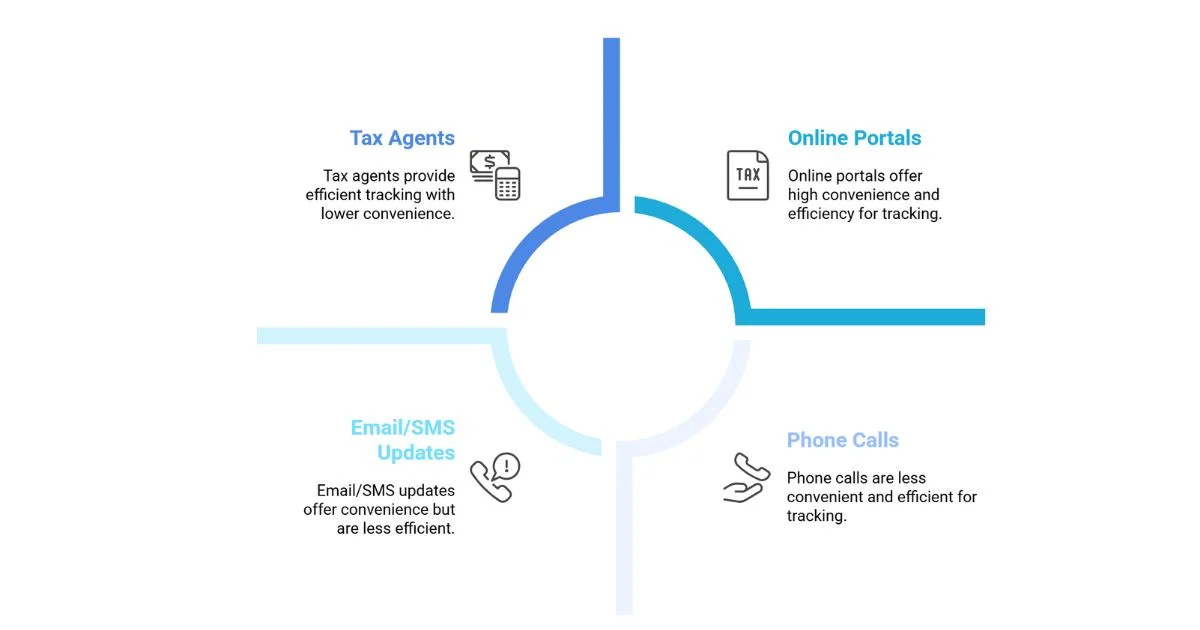

Methods to Track Your Tax Return

There are different ways to track your tax return. Most countries have online tools or portals where you can check the status. You can also track your tax return by phone or through a tax agent if you used one.

1. Using Online Portals

Many tax offices provide online systems for taxpayers. These portals are secure websites where you can log in using your tax ID or personal details. Once you log in, you can see the status of your tax return.

Online portals often show the following information: whether your return has been received, if it is being processed, if any issues have been found, and if a refund is approved. The system may also give an estimated date for your refund.

Using an online portal is the fastest and easiest way to track your tax return. You can check it anytime from your computer or phone.

2. Tracking Through Email or SMS

Some tax offices send updates through email or SMS. If you provided your email address or phone number when filing, you may receive notifications about your return. These messages may tell you that your return is received, under review, or approved.

Receiving updates via email or SMS is convenient because you do not need to log in to check your return. Make sure your contact details are correct when filing your return so you do not miss any updates.

3. Contacting the Tax Office by Phone

If you prefer, you can also call the tax office to check the status of your return. Make sure you have your tax details ready, such as your tax file number or reference number. The tax officer can tell you the current status and if any action is needed.

Calling can be helpful if your return has special circumstances or if you are not able to check online. However, phone lines may be busy during peak tax season, so it might take some time to get through.

4. Using a Tax Agent

If you used a tax agent to file your return, they can track it for you. Tax agents often have direct access to the tax office systems and can check the progress quickly. They can also handle any issues that arise and give advice if something is missing from your return.

Using a tax agent is helpful if you do not want to deal with the tax office yourself. They can make the process easier and less stressful.

Understanding Tax Return Status

When tracking your tax return, you may see different status messages. It is important to understand what they mean.

- Received: Your tax return has been submitted and accepted by the tax office.

- Being Processed: The tax office is checking your return and calculating your refund or tax payable.

- Needs More Information: The tax office requires additional documents or clarification.

- Approved: Your tax return has been checked, and the refund will be paid or your tax is finalised.

- Refund Paid: Your refund has been sent to your bank account.

Knowing the meaning of each status helps you understand what is happening with your return and if any action is needed from your side.

Common Issues That Can Delay Your Tax Return

Sometimes, lodging a tax return during tax time takes longer than expected. There are several common reasons for delays that you should be aware of.

One reason is missing or incorrect information. If you forget to include details, such as work-related expenses, sole trader income, or amounts for the Medicare levy, the Australian Taxation Office (ATO) may contact you to fix them. Another reason is complex returns, such as business income, rental income, or foreign income. These returns need more checks and take longer to process.

Technical issues can also cause delays, like problems with ATO online services, myGov account, or the ATO app, or missing documents needed to prepare your tax return. Finally, tax offices are usually very busy during peak season, which can slow down processing. Understanding these reasons can help you be patient and take action if needed.

Tips for Tracking Your Tax Return Effectively

Tracking your tax return online is easy if you follow some simple tips:

- Keep your tax details handy, such as your tax file number, reference number, or login details for your myGov account. These are needed to check your status.

- Check your return regularly, but do not worry if it is taking time. Most returns are processed within a few weeks, but some may take longer.

- Ensure your contact information is correct when filing. This ensures that emails, SMS, or letters from the Australian Taxation Office (ATO) reach you.

- Respond quickly if the ATO requests more information. This can prevent further delays and help manage your tax refund.

- Keep copies of all documents you submitted, including records for tax offsets, support loans, and deductions used to reduce your taxable income.

Finally, be patient and stay informed. Tracking your return regularly reduces stress and keeps you updated about any changes.

How to Track Refunds

If you are expecting a tax refund, tracking it is very useful. ATO online services and the ATO app usually provide an estimated refund date. Refunds are usually paid directly into your bank account, so make sure your banking details are correct.

If your refund is delayed, tracking can help you identify the reason. Sometimes, refunds are delayed due to missing documents, errors, or verification checks. By checking your status in your myGov account, you can contact the Australian Taxation Office (ATO) early and fix the issue.

Using Technology to Make Tracking Easier

Technology has made tracking tax returns easier than ever. Many taxpayers use the ATO app or ATO online services for real-time updates. You can receive notifications, view status updates, and check refund progress easily. Using these tools reduces the need to call or visit the tax office. You can track your return from anywhere using a phone or computer. Make sure you use secure websites or official apps to protect your personal information.

What to Do If There Are Problems

Sometimes, tracking shows that there is a problem with your tax return. Do not panic. First, read the message carefully to understand what is needed. It could be a missing document, an incorrect number, or extra verification.

Next, respond quickly by providing the required information. If you are unsure, you can contact a registered tax agent or the Australian Taxation Office (ATO) for help. Acting quickly helps your return get processed faster and ensures smooth management of your tax for the current income year.

Benefits of Tracking Your Tax Return

Tracking your tax return has many benefits. First, it keeps you informed about your return’s progress and whether your pre-fill information was used correctly. Second, it helps you plan your finances by knowing when you will get your tax refund. Third, it allows you to fix problems quickly, preventing further delays.

Finally, tracking reduces stress. Waiting for a tax refund or dealing with issues like support loans, tax offsets, or unexpected Medicare levy charges can be frustrating, but knowing the status gives peace of mind. You can focus on other important tasks while staying updated about your return.

Frequently Asked Questions (FAQ)

1. How do I track my tax return?

You can track your tax return using the official online portal of your tax office. Log in with your tax ID or personal details to see the status.

2. How do you see the progress of your tax return?

The progress can be seen online through the tax portal, by email or SMS updates, or by contacting the tax office directly.

3. How can I check my income tax return status online?

To check online, visit your tax office’s official website, log in with your details, and view your return status. You will see if it is received, being processed, or approved.

4. How long does it take for a tax return to be processed?

Processing time depends on how you file and the complexity of your return. Online returns are faster, usually a few weeks, while paper returns may take longer.

5. What should I do if my tax return is delayed?

Check the status online or contact your tax office. Sometimes delays happen due to missing documents, errors, or verification checks. Responding quickly can help speed up the process.

Conclusion

Tracking your tax return is an important step after filing. It helps you stay informed, plan your finances, and fix any issues quickly. You can track your return online, by email, phone, or through a tax agent. Understanding the status messages, common delays, and how to respond helps you manage the process easily.

Remember to keep your tax details handy, check your return regularly, and respond quickly if needed. By tracking your tax return carefully, you can reduce stress and make sure your refund or tax finalisation happens smoothly. For expert guidance and assistance, you can also consult SMG Accounting Services, which can help you track your return and manage your taxes efficiently.

With these simple steps, tracking your tax return becomes easy and worry-free. Always stay informed, stay patient, and take action when necessary to ensure your tax matters are handled correctly.