Running a small business can be rewarding — you’re your own boss, you control your work, and you have the chance to build something meaningful. But with that freedom comes responsibility, especially when it comes to managing money, paying taxes, and planning for growth.

Many small business owners make the same mistakes. These mistakes can quietly reduce profits, increase stress, and even cause problems with the Australian Taxation Office (ATO). The good news is that these mistakes can be avoided if you know what to do and take action early. Recent discussions, such as the super tax debate, highlight everything wrong with Australia’s media and economic system, showing how complex tax rules and public misunderstandings can affect small business decisions.

In this guide, we’ll cover five of the most common mistakes small business owners make — and show you how to avoid them with simple, practical steps.

1. Choosing the Wrong Tax Structure

Your business structure determines your tax obligations, how much business taxes you pay, your legal responsibilities, and how well your personal assets are protected. In Australia, the main structures are:

- Sole Trader: Simple and low-cost to set up, but you are personally responsible for all debts and obligations.

- Partnership: Owned by two or more people who share income, losses, and responsibilities.

- Company: A separate legal entity that provides liability protection but comes with more rules and reporting requirements.

- Trust: Used for asset protection and tax flexibility, but requires careful management.

Why does this mistake happen?:

Many business owners choose the cheapest or fastest option without understanding the long-term tax consequences or Australian business rules.

Risks of the wrong structure:

- Paying more business taxes than necessary.

- Limited protection for personal assets.

- Difficulty attracting investors or growing the business.

- Higher administrative costs if you need to switch structures later.

Step-by-step to choose the right structure:

- Assess your income and growth potential – Higher profits may benefit from different tax rates.

- Consider asset protection – If your industry has risks, choose a structure that limits personal liability.

- Compare compliance requirements – Some structures have more paperwork or require regular business activity statements (BAS).

- Get advice from a tax professional –They can help you choose the best structure for your situation and optimise your tax return.

- Review annually – As your business changes, make sure your structure still suits your tax obligations.

3. Delaying Hiring the Right People

As your business grows, doing everything yourself can hurt your cash flow, tax obligations, and overall efficiency. Waiting too long to hire staff can reduce productivity, hurt customer service, and limit growth potential.

Why does this mistake happen?:

Many business owners try to save money on wages but end up losing more due to missed opportunities, mistakes, and PAYG withholding obligations.

Risks of delaying hiring:

- Poor customer service from slow response times.

- Missed deadlines and lost sales.

- Owner burnout and increased errors.

- Limited ability to take on new projects or clients.

Signs it’s time to hire:

- You consistently work long hours just to keep up.

- You turn down work because of limited capacity.

- Routine tasks take time away from strategic business work.

Step-by-step hiring plan:

- Identify tasks to delegate: Focus on jobs others can do so you can manage higher-value work.

- Decide the role type: full-time, part-time, casual, or contractor.

- Write a clear job description: include duties, skills, and expectations.

- Recruit effectively: use job boards, recruitment agencies, or referrals.

- Train thoroughly: provide clear instructions, resources, and feedback.

- Monitor performance: regular check-ins ensure new hires meet your standards.

4. Running a Business Without a Profit Plan

Many small business owners focus on sales but forget to track real profit. Understanding break-even and profit is important. The break-even point tells you how much you need to earn to cover all costs, while profit shows how much money remains after paying expenses. Without tracking these, your business may earn revenue but still struggle financially.

A business without a profit plan risks running out of cash, making pricing mistakes, and having no funds to reinvest.

Why does this mistake happen?:

Owners often confuse high sales with success, but without monitoring costs, those sales can be unprofitable.

Risks of no profit plan:

- Working hard without making money.

- Running out of cash for essential expenses.

- Making pricing mistakes.

- Struggling to reinvest in the business.

Step-by-step to create a profit plan:

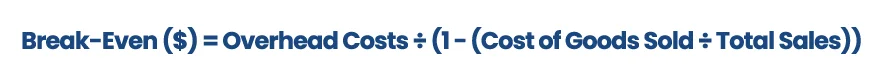

- Calculate your break-even point: The amount you must earn to cover all expenses. Knowing your break-even point helps you understand when your business starts making a profit.

To calculate break-even in dollars:

Use this formula:

This tells you the amount of money your business needs to earn to cover all costs before making a profit.

To calculate break-even in units (how many items to sell):

Use this formula:

This tells you how many products you need to sell to cover all your expenses and start earning profit.

2. Set a clear profit goal: Decide how much profit you want each year.

3. Forecast income and expenses: Estimate monthly revenue and costs.

4. Track performance: Use profit and loss statements to measure progress.

5. Adjust as needed: Increase prices, reduce costs, or improve efficiency if profits are lower than planned.

6. Review regularly: Quarterly reviews keep your plan accurate.

Tools to use:

- Accounting software with reporting features.

- Spreadsheet templates for budgeting and forecasting.

- Financial dashboards to see profit trends at a glance.

5. Limiting Growth by Thinking Too Small

Growth doesn’t happen by accident — it requires planning, investment, and a willingness to think beyond day-to-day operations. Some business owners stay in a “survival mode” mindset for too long.

Why does this mistake happen?:

Fear of risk, lack of confidence, or comfort with the status quo can keep owners from exploring bigger opportunities.

Risks of thinking too small:

- Stagnant sales.

- Missed market opportunities.

- Losing customers to more innovative competitors.

Step-by-step to think bigger:

- Set long-term goals: Look 3–5 years ahead and define where you want to be.

- Research new opportunities: New markets, products, or customer groups.

- Build scalable systems: Processes that allow growth without chaos.

- Invest in marketing: Promote your brand consistently to reach more people.

- Keep learning: Stay updated on industry trends and business strategies.

- Network with others: Collaborate with other business owners and industry groups.

Frequently Asked Questions (FAQ)

Do you pay taxes on your own small business in Australia?

Yes. If you run your own small business, you must pay tax on the income you earn. How much you pay depends on your business structure and profit. Sole traders pay tax on their personal income, while companies pay company tax. Keeping accurate records helps you pay the right amount.

What are the biggest tax mistakes business owners make?

Some common mistakes include choosing the wrong tax structure, not keeping proper records, claiming wrong deductions, and missing deadlines. These mistakes can cost money and cause problems with the ATO. Following a clear plan and getting professional help can prevent these mistakes.

What is the best way to reduce taxes in Australia?

The best way is to plan carefully. Use the correct business structure, keep good records, claim all legal deductions, and work with a qualified accountant. Planning ahead helps you pay only what you need and avoid paying too much tax.

How do I get a bigger tax refund in Australia?

You can increase your refund by making sure you claim all deductions you are entitled to, such as business expenses, super contributions, and work-related costs. Accurate record keeping and professional advice help you get the refund you deserve.

How much tax is there in Australia for foreigners?

Foreigners who earn money in Australia also pay tax. The rate depends on income and whether the money is from work or investments. The ATO provides clear tables to show how much tax is payable. Professional advice can help ensure foreigners pay the correct amount.

Final Thoughts

Avoiding common business mistakes can make a huge difference in the success and growth of your small business. Choosing the right tax structure, keeping accurate records, hiring the right people at the right time, creating and following a profit plan, and thinking bigger about your business goals will help you save money, reduce stress, and build a stronger business.

The key is to be proactive. Review your current practices, identify areas that need improvement, and take action before small issues become costly problems. A small change today can prevent major challenges in the future.

Running a business is not easy, but you don’t have to do it alone. SMG Accounting Services Pty Ltd. offers expert advice and personalised support to help you make smart decisions about taxes, record keeping, staffing, and business planning. With the right guidance, you can focus on growing your business while knowing your financial and compliance needs are well-managed.

Ensure your business succeeds with the right support.