Managing a small business brings both opportunities and challenges. While generating sales and serving customers is important, keeping a close eye on cash flow is essential for long-term success. Cash flow, the movement of money into and out of your business, ensures bills are paid, employees are compensated, and growth remains possible. Even profitable businesses can face difficulties if cash flow isn’t carefully monitored.

Many small business owners focus on increasing sales and attracting customers, but they often overlook the importance of monitoring cash flow. Ignoring this critical area can lead to financial stress and even business failure.

In this article, we’ll look at the most common cash flow mistakes small business owners make and how to avoid them.

Not Knowing Your Cash Flow Situation

A common mistake is not knowing exactly where your money is going. Without proper tracking of income and expenses, it’s easy to overspend or run into shortfalls. Some business owners rely only on bank statements or mental notes, which is risky.

To avoid this, regularly monitor your cash flow. Use simple spreadsheets or accounting software to record all money coming in and going out. Knowing your cash position allows you to make informed decisions, avoid surprises, and plan for future growth.

Using Personal and Business Accounts Together

Mixing personal and business finances is a trap many small business owners fall into. Using a single account for both types of spending can create confusion and make it hard to know your true cash flow situation.

Keep separate accounts for business and personal use. Pay yourself a consistent salary from the business account rather than taking money as needed. This practice not only clarifies your financial picture but also simplifies tax preparation and improves your credibility with banks and investors.

Neglecting Your Credit Score

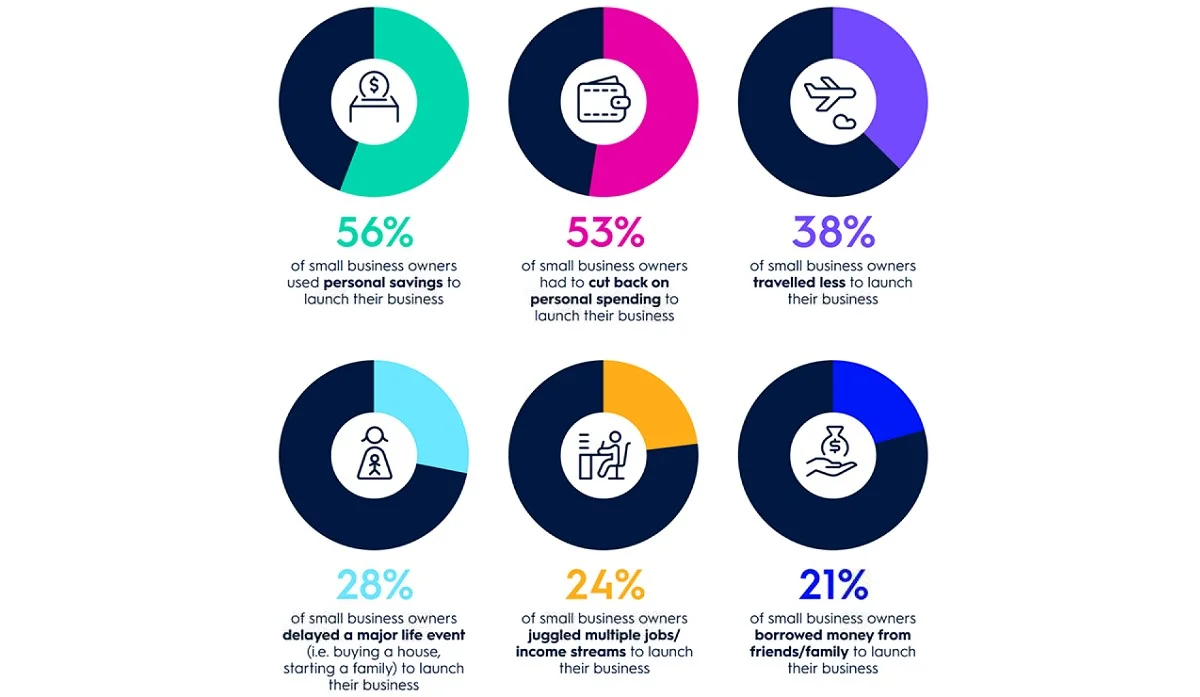

Your credit score plays a crucial role in accessing loans, credit lines, or better payment terms from suppliers. Most small businesses start with their own money, with around 56% relying on personal funds to launch their operations. Failing to monitor your credit can limit your ability to borrow when needed and may lead to higher interest rates.

Image Source: AMP

Stay on top of your credit reports and ensure bills and loans are paid on time. Maintaining good credit helps keep your business financially flexible and protects you from unexpected cash flow issues.

Underestimating the Role of Cash Flow

Many business owners focus solely on profits, thinking that as long as sales are high, the business is safe. However, profits alone don’t guarantee financial stability. Poor cash flow can occur even in profitable businesses if money is not coming in when needed or expenses are poorly timed. Recent research shows that about 80% of small and medium businesses in Australia have faced major cash flow problems in the past year.

Track your cash flow daily or weekly and analyse trends to anticipate potential shortfalls. Understanding how money moves in your business is key to making smarter financial decisions.

Overlooking Tax Implications

Taxes can be a hidden drain on cash flow. Making business decisions without considering tax consequences can result in unexpected liabilities. Late tax payments can also lead to penalties and interest, further straining your finances.

Plan ahead for taxes, keep accurate records, and consider consulting a professional accountant. Being proactive ensures you don’t face surprises that could disrupt your cash flow.

Setting Prices Too Low

Pricing products or services too low might attract customers, but it can harm your cash flow. If your prices don’t cover costs and leave room for profit, you’ll struggle to pay bills, invest in growth, or save for unexpected expenses.

Develop a pricing strategy that helps you balance fair prices with healthy profits. Analyse your costs carefully and set prices that reflect both your expenses and the value you provide. Don’t be afraid to adjust pricing when necessary, especially if your costs increase.

Skipping Financial Planning and Record-Keeping

Neglecting financial planning and record-keeping is a major mistake for small business owners. Without organised records, it’s difficult to track the amount of cash available, monitor operating cash flows, or identify potential financial issues before they escalate.

Keep detailed records of income, operating expenses, invoices, and receipts. Use your cash flow statement and income statement to analyse performance regularly. Creating a budget and comparing it to actual results helps maintain working capital and ensures the financial health of your business.

Overestimating Sales

It’s natural to be optimistic about revenue, but overestimating sales can create serious problems. If you spend based on overly optimistic forecasts and sales don’t meet expectations, you may struggle to pay bills or employees.

Use conservative estimates when planning budgets and cash flow forecasting. Include a buffer for slow periods or unexpected events to protect your bank account and overall stability. Monitoring accounts receivable and accounts payable helps prevent potential negative cash flow situations.

Late Invoicing and Poor Credit Management

Late invoicing or failing to follow up on unpaid bills can quickly create challenges for your working capital. When clients delay payments, your ability to cover operating expenses is affected.

Send invoices promptly, establish clear payment terms, and follow up consistently. Offering small incentives for early payments encourages timely transactions. Consider using invoicing software to automate reminders and streamline the process. Proper management of accounts receivable ensures your statement of cash flows remains accurate.

Ignoring Expenses

Focusing only on revenue while neglecting expenses is another common error. Small, overlooked costs can accumulate and harm your financial health.

Track all operating expenses, no matter how small, and review them regularly. Identify areas where spending can be reduced without affecting operations. This keeps your bank account in good shape and allows funds for investing activities and growth initiatives.

Failing to Plan for Seasonal Changes

Many businesses experience seasonal fluctuations. Retail stores, tourism-related businesses, and service providers often have busy months followed by slower periods. Failing to plan for these fluctuations can create financial strain.

Create a cash flow forecast that accounts for busy and slow seasons. Save surplus cash equivalents during peak months to cover expenses when sales dip. Planning ahead ensures stability and protects your working capital throughout the year.

Taking on Too Much Debt

Borrowing can support growth, but taking on too much debt can strain your operating cash flows. Loan repayments and interest costs can quickly become burdensome if revenue isn’t consistent.

Before borrowing, assess your ability to repay. Understand the interest rates, repayment schedule, and how financing activities impact your statement of cash flows. Borrow strategically to support growth rather than cover gaps caused by poor planning.

Paying Bills Late

Delaying bill payments to preserve cash temporarily can damage relationships with suppliers and result in fees or penalties.

Always aim to pay bills on time. If needed, negotiate extended payment terms. Good payment practices improve trust, maintain working capital, and protect the financial health of your business.

Not Having a Cash Reserve

Unexpected expenses can arise at any time, from equipment failures to delayed client payments. Without a cash reserve, these surprises can disrupt operations and create stress.

Set aside a portion of income regularly to build a buffer. Even a small reserve improves financial flexibility and protects your bank account. Think of it as insurance for your business and your operating cash flows.

Poor Inventory Management

Holding too much inventory ties up working capital, while too little stock can result in lost sales. Poor inventory management can secretly harm your financial health.

Review inventory levels regularly and adjust based on sales trends. Use inventory management tools to maintain balance and keep funds available for investing activities. Proper management ensures positive cash flow and reduces unnecessary cash flow problems.

Not Reviewing Financial Reports

Ignoring financial reports can hide potential issues until they become severe. Some business owners assume steady sales mean everything is fine, but this can be misleading.

Make it a habit to review income statements, balance sheets, and statements of cash flows monthly. These insights help you monitor accounts receivable, accounts payable, and working capital, allowing you to make informed decisions and spot problems early.

Relying on One Client or Income Source

Relying heavily on a single client or revenue stream is risky. If that client delays payment or leaves, your operating cash flows can be immediately affected.

Diversify clients and income streams wherever possible. This reduces risk, strengthens financial health, and makes cash management easier. Monitoring accounts receivable, accounts payable, and your bank account ensures your business remains resilient.

Hiring Too Quickly

Growing a business is exciting, but hiring too fast can strain cash flow. Salaries, benefits, and training costs add up quickly. Without careful planning, new hires can become a financial burden rather than an asset. If you hire someone who isn’t the right fit, it can cost a lot more than usual. On average, hiring a new employee costs about $7,500.

Hire strategically and ensure your business can sustain additional employees. Temporary or part-time staff can be a flexible solution until your cash flow supports permanent hires.

Conclusion

Cash flow is the lifeblood of any small business. Even profitable companies can struggle if they fail to manage it properly. Avoiding common mistakes, from mixing personal and business finances to over-borrowing or ignoring reports, can help you maintain a healthy cash flow and grow sustainably.

The key is to stay proactive. Monitor cash flow regularly, plan for unexpected expenses, and make informed financial decisions. Understanding your business finances, staying organised, and making thoughtful choices allows you to focus on what matters most: growing your business and achieving your goals.

With the support of SMG Accounting Services, you can get expert guidance on cash flow management, bookkeeping, and financial planning. Our professional services help small business owners make smarter decisions, avoid common pitfalls, and maintain steady growth.